Even Sandwich Generation Can Enjoy Life

Are you a sandwich generation? If you are juggling between footing the bills for your parents and raising your children, then consider yourself part of the sandwich group.

With the rising cost of living and the economic shocks arising from the Covid-19 pandemic, sandwich generation members are coming under increasing financial stress.

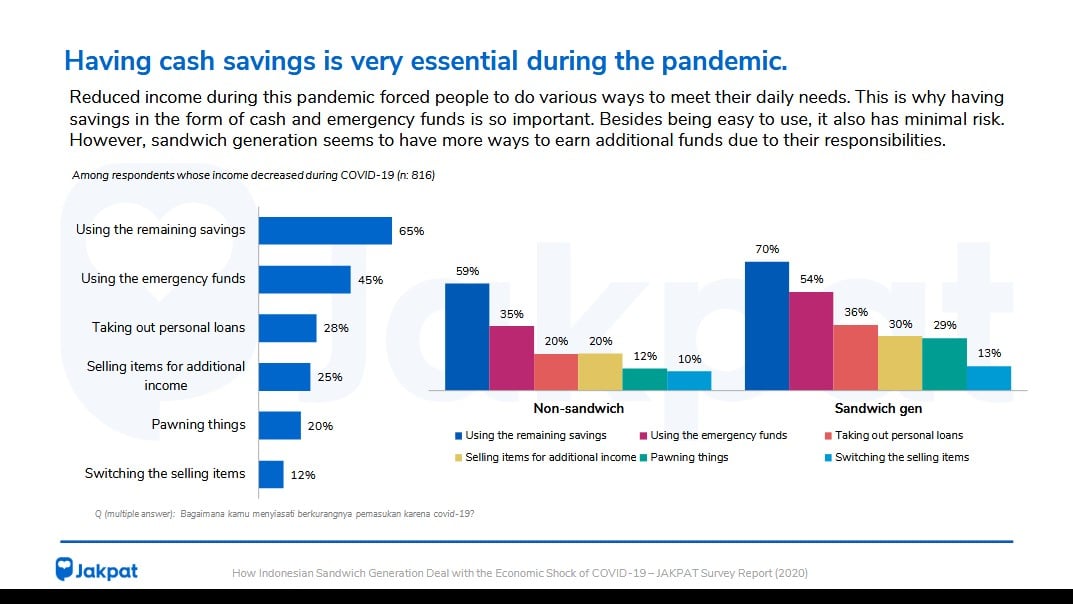

When the pandemic struck, Indonesian sandwich group turned to their savings and selling household items to cope as people lost jobs and businesses collapsed. According to a Jakpat study, 70% of sandwich generation members with shrinking income used their savings to cover daily expenses in the pandemic. That compared to 59% of non-sandwich people tapping their savings to meet living expenses.

Source: Jakpat

The study further showed that 30% of sandwich members sold their items to raise additional cash for living expenses in the pandemic. In contrast, just 20% of non-sandwich members sold items to cover budget shortfalls.

Source: Jakpat

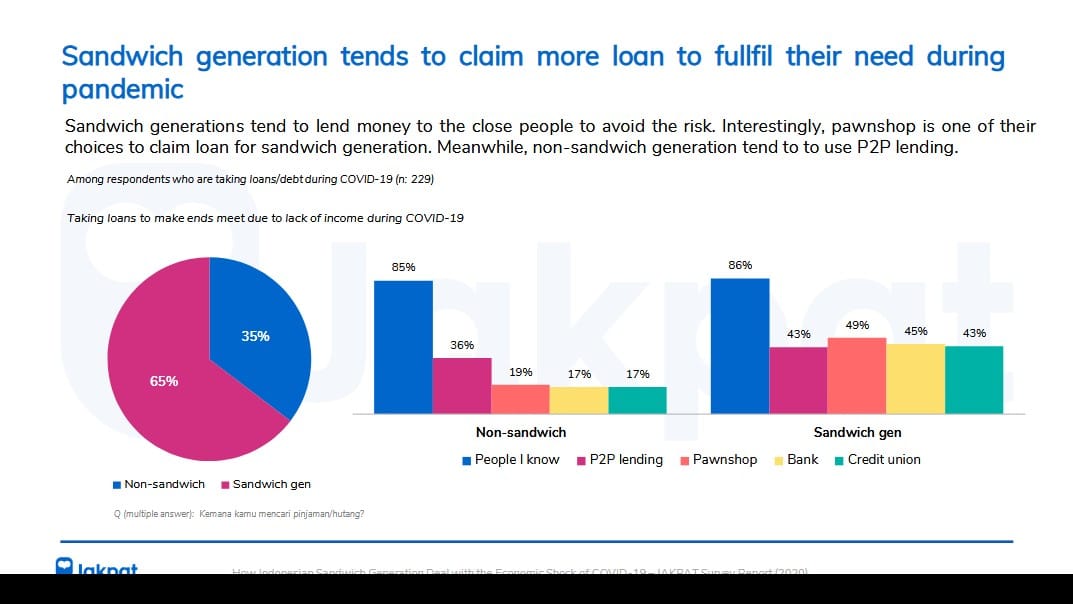

Moreover, the pandemic drove more sandwich generation members into debt. The Jakpat study showed 65% of sandwich members took personal loans from banks, credit unions, lending apps, and friends to make ends meet in the pandemic. That compared to just 35% of non-sandwich people borrowing to survive the pandemic.

Indeed, being faced with competing financial demands from parents and children can take away your peace and sink you into depression. But life doesn’t have to be frustrating for sandwich generation. There are steps you can take to enjoy life even if you are caught between the financial demands of parents and children.

Accept the situation and make use of available resources

Many people feel morally responsible to meet their parents’ needs. The problem comes if the income is not enough to care for both parents and the kids. Things can get even more stressful if you have a busy career.

If money is a problem, which is for most sandwich generation, frankly talk about the financial reality with the parents. That would solve the problem of the parents mistakenly assuming you have more money to spend on them than you actually do.

After you have painted your real financial picture to the parents, now listen to them. The parents may have savings or pension you didn’t know existed. Tapping into the savings or pension can allow you to give your family a more comfortable life while reducing your financial pressure.

Supporting parents and children at the same time can be bearable if you reach out to your siblings or relatives willing to chip in. You may be the one with the biggest salary, but the small contributions from the siblings and relatives can take care of some bills and reduce your financial burden.

Join sandwich generation forums

Many people are in the sandwich situation. You can obtain valuable ideas and inspiration by joining online sandwich generation groups. For example, you can learn how to generate extra income and cope with work and family stress in the forums. In turn, you could live a more meaningful life as a sandwich generation.

Put yourself first to break the chain

The responsibility of covering living expenses for your parents landed on your shoulders may be because the parents lacked retirement savings. If you are not careful, your children might bear even greater financial responsibility providing for you and their kids.

You can save your children the sandwich generation burden by having a financial plan for your retirement. Therefore, even as you juggle the responsibility of providing for your parents and children, make sure to save for the future.