How Can Loan Restructuring Scheme Affect Your Finances?

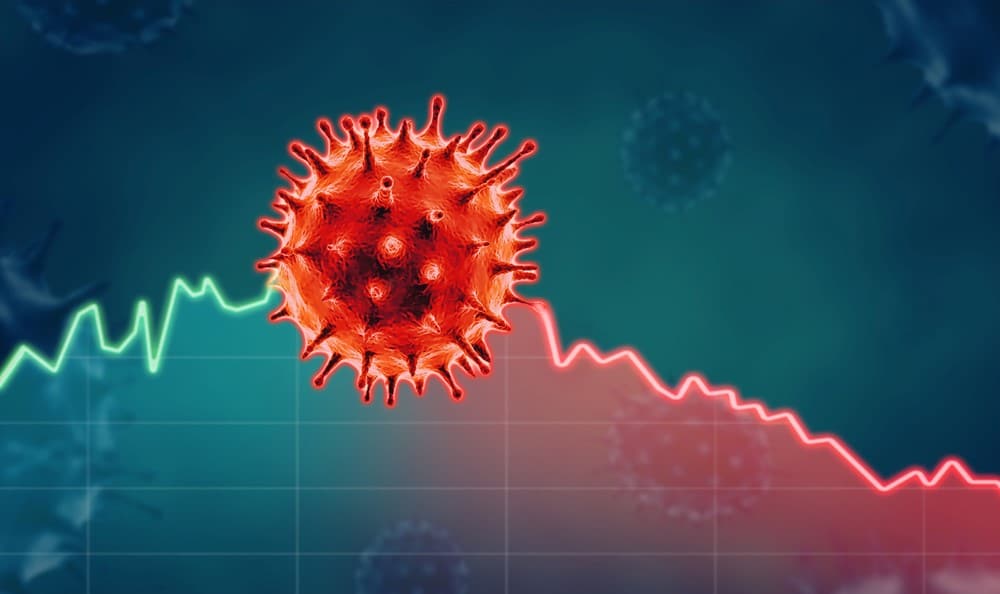

The credit market is critical to the sustenance of business operations. In times of crisis like the ongoing COVID-19 pandemic, business operations across the economy are disrupted. This disruption starves businesses of income, and they find it challenging to stay afloat. Creditors often come in at this point to secure the survival of the businesses through loans.

But what happens when the business had loans from before the crisis, and it needs to pay back? It is a familiar situation in Indonesia and even across the globe. As of quarter 1, 2020, the economy was already showing signs of stress. Immediately after it was clear that businesses required a helping hand, the Financial Services Authority (OJK) instituted a loan restructuring process.

What is a loan restructuring scheme? How does it happen?

Perhaps you are already asking yourself, what is a debt restructuring scheme? What does it entail? A loan restructuring scheme refers to the adjustment of the terms of agreement of the existing loan. This scheme mostly aims to help borrowers to manage the loan given unexpected and unavoidable circumstances.

The creditor carries the restructuring scheme out of the need to avoid the case where the borrower might fail to pay up completely. The restructuring process entails extending the loan’s term. So, if your loan was due in one year, the creditor might consider adding six more months. Effectively, this reduces the instalment amount you need to make. Alternatively, a creditor might modify the interest charged on the principal sum. The adjustment is usually downwards, which reduces the total loan amount payable.

When a creditor has to restructure a loan, it means the condition of the borrower is dire. It means the borrower has considered every option available, but none is fruitful in enabling the loan repayment. For example, COVID-19 necessitated lockdowns that brought economic activities to a sudden stop. Some people saw their incomes dry up through layoffs and business closure. Without loan restructuring, the next option available was to default. Because the restructuring scheme is an extreme alternative, it carries some costs.

How the scheme impacts your finances

This scheme can affect your finances in various ways, including:

- You will pay a processing fee

Creditors charge a processing fee to facilitate the restructuring scheme. The fee is often charged as a percentage of the total amount of the loan. Different creditors will charge a different fee.

- Increased rate of interest

When creditors give out loans, they have a timeline within which this debt should be repaid. The loan often comes from other investors who expect interest payments on their capital at specified time intervals. If this does not happen, the creditor might incur some penalties.

For this reason, you are likely to incur higher interest rates on the restructured loan. The higher interest payment will help the creditor cover the penalties incurred if it delays interest payments to investors.

- Increased loan amount

Because of the processing fee, the higher interest rates, and any other costs, you will end up paying a higher loan amount than before restructuring. The compound interest effect balloons the total loan amount, and it gets more significant with higher interest rates or longer payment periods.

Other than the compound interest effect, some creditors demand high-value collateral before instituting the restructuring scheme. If you end up defaulting even after restructuring, you may end up incurring much more money than you could fathom.

Should you avoid loan restructuring?

Nobody finds oneself in a situation where loan restructuring is necessary by choice. However, some people would instead restructure their debts than liquidate their investments to clear the loan. Nonetheless, borrowers are better at prioritizing the loan’s clearing even if it means ceding ownership of assets such as stocks.

Instead of making new investments while there is a pending loan that might require restructuring, it’s better to repay the money owed first. Other than saving extra interest costs and a tainted credit rating, repaying outstanding loans by all means could help you reset your financial situation for a better and fresh start.