Is It Right To Pay Debt In Installments?

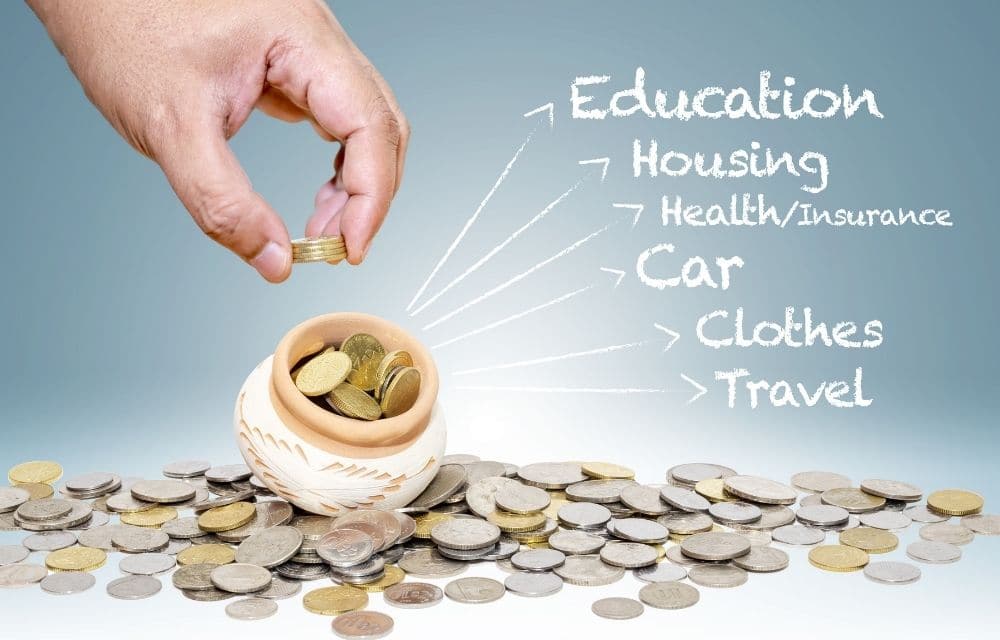

You may take a loan to fund a business venture or investment if your savings are insufficient. Many people also obtain credit to finance big-ticket purchases such as buying a house or car. Others may borrow to finance home furnishing, go on vacation, or cover medical bills.

Having a debt is commonplace these days. However, there are times when servicing debt may become a problem. While clearing your debts is good for your financial future, many people run into problems when repaying debts doesn’t leave them with enough money to maintain a comfortable lifestyle.

If servicing debts drains your income and weighs on your cash flow, you may want to explore your debt repayment options. You can clear debt in two main ways. You can pay off the debt immediately or over time through regular instalment payments.

Paying off debt immediately is what often causes cash flow problems for many people. It involves parting with a large chunk of your income at once to pay your creditors. That may leave you with little money to spend on your family and invest.

You can strike the right balance by going the instalment way. Instalment plan allows you to break up debt into small chunks to make repayment more manageable. Instalment payments are made in monthly schedule. With instalment loans, you know how much you will need to pay in a month and how long it will take to clear the debt.

As instalment makes debt repayments predictable, and budgeting your income becomes easy. Instalment payment allows you to reduce the debt gradually while retaining enough money on your income to give your family a good life and invest for the future.

Which is better between paying off debt immediately and in instalments?

Paying off immediately or over time are both practical ways to clear debt. Both debt repayment plans have their benefits and drawbacks. Therefore, one method may be more suitable for a particular debt case than the other.

Paying off debt immediately allows you to clear the debt burden quickly and focus on other matters of your life. Moreover, you can make significant savings on interest by clearing a loan immediately. However, striving to pay off debt immediately can shrink your cash flow and interfere with your normal life. Therefore, paying off debt immediately may be suitable where small amounts are involved.

Meanwhile, paying debt in instalments may be best where you have a huge debt to clear and cannot afford to do it at once. Instalment plan also ensures you don’t drain your income on debt that could adversely impact the quality of your life.

However, as you will be paying the debt in small bits for a long time, you may end up paying more in interest with an instalment plan. With instalment debt payment, you can run into problems if you lose your job or your income drops significantly before you clear the debt.

There is also the risk of forgetting to make a payment on an instalment plan. Many lenders will hit you with a late payment fee if you fail to make your instalment payment on time. The late penalties can add up fast and complicate your debt repayment. However, you can avoid skipping instalment payments and escape the late penalties by setting up an automatic repayment schedule.