Overcome Your Financial Difficulties

We know that debt collection issues can be challenging and stressful. It is a sensitive subject, but you don't have to face it alone.

With resources from FlowCares, we can help you understand how debt collection works and learn to better manage the debt that you have.

Received an SMS or a call from us?

- Go to your account to make loan payment;

- View status of settlement transaction;

- Check your balance and get dedicated support from our debt specialist support team.

Frequently Asked Questions

-

The weight of debt can add emotional, relational, and financial stress to our lives. Overdue debt could lead to legal proceedings and also affect your creditworthiness for future borrowing. Paying off your debt and becoming debt-free puts you more in control of your money.

-

A debt collector collects debts owed, commonly when those debts are past due. Debt collectors include original creditors, third-party collection agencies and buyers who purchase past due debts from the original creditors.

A debt collector may be contacting you if you are past due on a debt, or to locate someone you know. Set up a payment plan with the debt collector to resolve the debt. If you do not owe the debt or have already paid the debt, it is important to take action and inform the caller.

-

When contacted, you should seek verification of the debt. Ask for:

- The identity of the debt collector, including name, address, and phone number.

- The information on the debt, from the amount owed to additional fees such as interest or collection costs.

- What the debt is for and when the debt was incurred.

- The name of the original creditor.

Do not disclose your personal or financial information to the caller until you have confirmed it is a legitimate debt collector.

-

Ask the debt collector for the name, company, address, and phone number. If the caller refuses to give you the necessary information about your debt or is trying to collect a debt that you do not recognise, it might be a fraudulent call.

Do not disclose your personal or financial information such as your bank account, credit card, or identification number to the caller until you have confirmed it is a legitimate debt collector.

-

If you believe you do not owe the debt or that it is not your debt, please drop us a call and send an email to the debt collector. Our debt specialist team will follow up accordingly.

For purchased portfolio accounts, if there is no prior log of the escalation – the borrower will need to file a police report and send in the report for us to investigate further with the seller. The debt seller will need to pull the data from the sales team on their end about how this account was sourced.

-

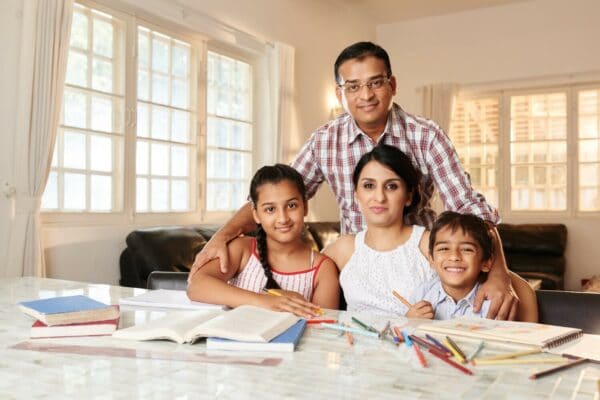

We understand that sometimes, borrowers may face unfortunate circumstances of job loss, illness, or bereavement not within their control and may not be able to pay the full amount on time. The best solution is to contact the debt collector to discuss an optimal payment plan, instead of avoiding the collection actions.

For Flow borrowers, please get in touch with us to discuss your financial situation. We will support you with free debt advice and help you set up a repayment plan that you can afford and find the best solution for you to pay off your debt.

-

If a debt collector contacts you about a debt you have already paid, you should let them know that you paid the debt.

You could also provide the debt collector with document proof on the confirmation of your payments. Only send copies and keep the originals. Keep records that you sent your dispute to the debt collector.

Always check the legitimacy of the debt collector before sending your sensitive personal and financial information across.

-

Yes, debt collectors do billing based on the data provided by the creditor. In the event of a discussion about the amount and balance, you can explain it to the debt collector and provide the data held as well as proof of communication or balance with the creditor via email or other communication channels.

Guides

Learn how to stay on top of your finances with our step-by-step guides